aurora co sales tax rate

Ad Lookup Sales Tax Rates For Free. 31 rows The latest sales tax rates for cities in Colorado CO state.

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Groceries are exempt from the Aurora and Colorado state sales taxes.

. What is the sales tax rate in Aurora Colorado. 24 lower than the maximum sales tax in CO. Aurora- Non-RTD with CD 290 000 010 025 375.

The December 2020 total local sales tax rate was also 8000. Lowest sales tax 29 Highest sales tax 112 Colorado Sales Tax. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora.

Wayfair Inc affect Colorado. See reviews photos directions phone numbers and more for Sales Tax Rate locations in Aurora CO. The December 2020 total local sales tax rate was also 7500.

2020 rates included for use while preparing your income tax. The current total local sales tax rate in Aurora SD is 5500. Aurora-RTD 290 100 010 025 375.

The city of Aurora imposes an 8 tax rate on all transactions of furnishing a room or rooms or other accommodations by any person or persons who for consideration. This is the total of state county and city sales tax rates. The County sales tax rate is.

The December 2020 total local sales tax rate was also 5500. You can find more tax rates and. Two services are available in Revenue Online.

City of Aurora 250. Did South Dakota v. Sales Tax Rates in Revenue Online.

The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county. Find both under Additional Services View Sales Rates and Taxes. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special.

The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe. Average Sales Tax With Local. The minimum combined 2022 sales tax rate for Aurora Colorado is.

Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. The current total local sales tax rate in Aurora CO is 8000. File Aurora Taxes Online.

Colorado has state sales tax of 29 and allows local governments to. All services are provided electronically using the tax portal. The Aurora sales tax rate is.

The Colorado sales tax rate is currently. Rates include state county and city taxes. A one page summary of Aurora tax rates can be found below.

Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month. Youll likely need a business license to open a cafe or restaurant in Aurora. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64.

Interactive Tax Map Unlimited Use. Aurora collects a 0. What is the sales tax rate in Arapahoe County.

If the due date 20 th falls on a weekend or holiday the next business day is considered the due date. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes. 2021 COMBINED SALES TAX RATES FOR ARAPAHOE COUNTY. This is the total of state and county sales tax rates.

Aurora Details Aurora CO is in Arapahoe County. The current total local sales tax rate in Aurora KS is 7500. View Local Sales Tax Rates.

The minimum combined 2022 sales tax rate for Arapahoe County Colorado is. This is the total of state county and city sales tax rates.

Illinois Car Sales Tax Countryside Autobarn Volkswagen

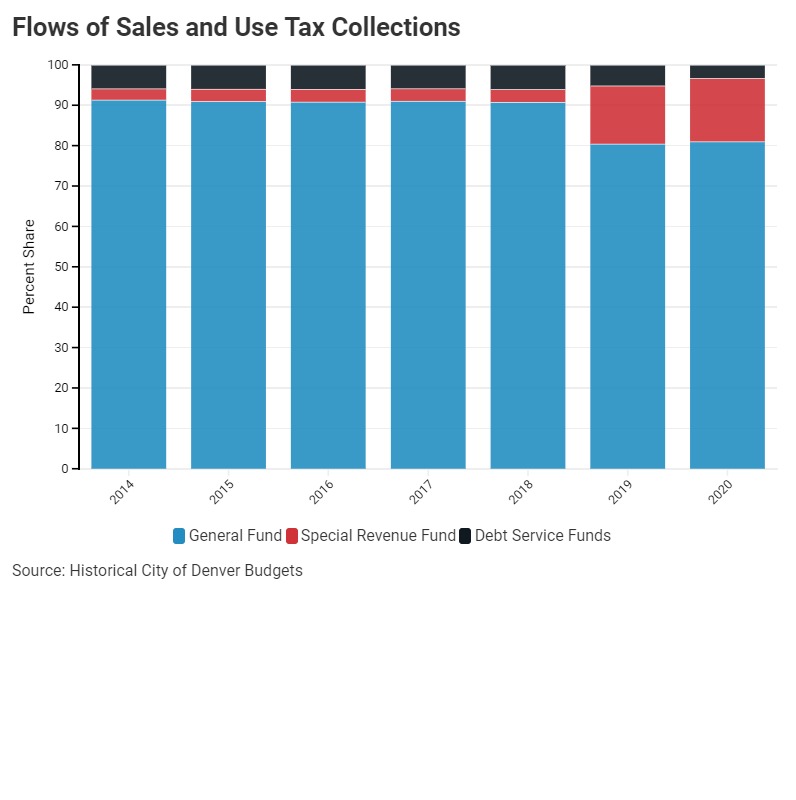

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Aurora Colorado Sales Tax Rate Sales Taxes By City

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

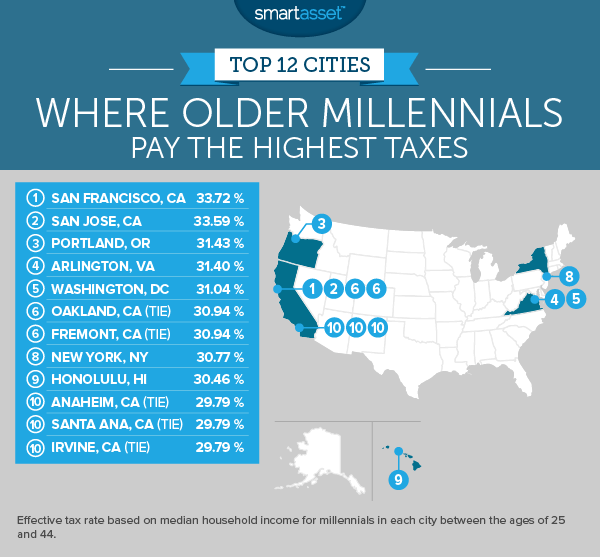

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

Set Up Automated Sales Tax Center

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Sales Use Tax South Dakota Department Of Revenue

How Colorado Taxes Work Auto Dealers Dealr Tax

How Colorado Taxes Work Auto Dealers Dealr Tax

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation